nd sales tax calculator

Therefore we prioritize updating the latest information so that. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you with a lot of relevant information.

State Corporate Income Tax Rates And Brackets Tax Foundation

The North Dakota ND state sales tax rate is currently 5.

. Thursday June 23 2022 - 0900 am. After choosing the number os Locations to compare a list of. North Dakota Title Number.

For vehicles that are being rented or leased see see taxation of leases and rentals. Free sales tax calculator tool to estimate total amounts. Year first registered of the vehicle this will be within one year of the model Shipping or gross weight of the new vehicle required depending on the type of vehicle.

This rate includes any state county city and local sales taxes. North Dakota Sales Tax Calculator Purchase Details. Administration salary can vary between 26500 to 88500 depending on factors including education skills experience employer location.

2020 rates included for use while preparing your income tax deduction. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up 132 compared to the same timeframe in 2021. If youre selling an item and want to receive 000 after taxes youll need to sell for 000.

Taxable sales and purchases for January February and March of 2022 were 47 billion. How much is sales tax in North Dakota. Avalara calculates collects files remits sales tax returns for your business.

In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and plate fees. The latest sales tax rate for Fargo ND. New farm machinery used exclusively for agriculture production at 3.

Then use this number in the multiplication process. The average total salary for a Administration is 49000 per year. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Sales tax data for North Dakota was collected from here. Local tax rates in North Dakota range from 0 to 35 making the sales tax. This includes the rates on the state county city and special levels.

Look up 2021 North Dakota sales tax rates in an easy to navigate table listed by county and city. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. North Dakota Sales Tax Calculator and Economy.

The sales tax is paid by the purchaser and collected by the seller. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Sales Tax Calculator Sales Tax Table.

To calculate registration fees online you must have the following information for your vehicle. How to Calculate Sales Tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

North Dakota assesses local tax at the city and county levels but does not assess local tax for special jurisdictional areas such as school districts or transportation authorities. ND Rates Sales Tax Calculator Sales Tax Table. In zip code Enter the zip code where the purchase was made for local sales tax.

North Dakota collects a 5 state sales tax rate on the purchase of all vehicles. This is based on data from 26 TurboTax users who reported their occupation as Administration and includes taxable wages tips bonuses and more. Exemptions to the North Dakota sales tax will vary by state.

The latest sales tax rates for cities in North Dakota ND state. Egeland is located within Towner County North DakotaWithin Egeland there is 1 zip code with the most populous zip code being 58331The sales tax rate does not vary based on zip code. North Dakota sales tax is comprised of 2 parts.

Free sales tax calculator tool to estimate total amounts. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959 on. If you are looking for the latest and most special shopping information for Nd Resale Tax Certificate results we will bring you the latest promotions along with gift information and information about Sale Occasions you may be interested in during the year.

Ad Avalara AvaTax Lowers Risk by Automating Sales Tax Compliance. 2020 rates included for use while preparing your income tax deduction. North Dakota Sales Tax.

Minus Tax Amount 000. Find list price and tax percentage. North Dakota Vehicle Registration Tax LoginAsk is here to help you access North Dakota Vehicle Registration Tax quickly and handle each specific case you encounter.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Promotions can be up to 59 with limited quantities. Or the following vehicle information.

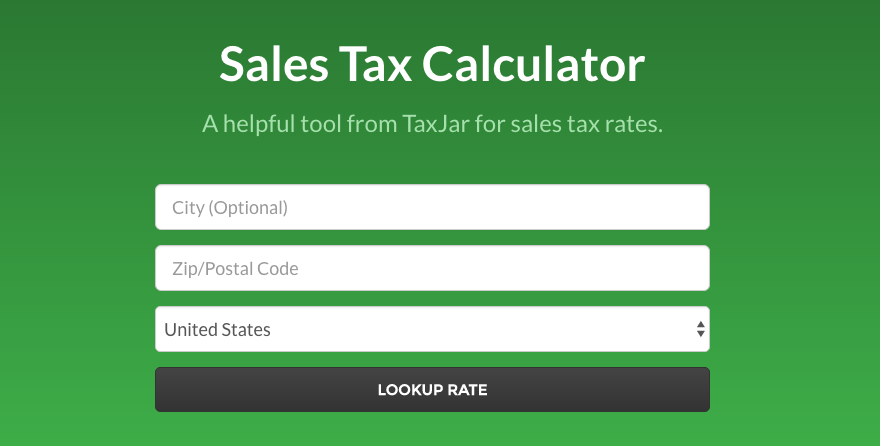

Depending on local municipalities the total tax rate can be as high as 85. Steps 1 to 3 will allow you to calculate Sales Tax on the net or gross sales cost of goods andor services for the area chosen. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Dakota local counties cities and special taxation districts.

See it in Action. Plus Tax Amount 000. Before Tax Amount 000.

The North Dakota sales tax rate is 5. Multiply the price of your item or service by the tax rate. To find the total sales tax rate combine the North Dakota state sales tax rate of 5 and look up the local sales tax rate with TaxJars Sales Tax Calculator.

Divide tax percentage by 100 to get tax rate as a decimal. Gross receipts tax is applied to sales of. Integrate Vertex seamlessly to the systems you already use.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. You can now choose the number of locations within North Dakota that you would like to compare the Sales Tax for the product or service amount you entered. You can find these fees further down on the page.

The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax. The base state sales tax rate in North Dakota is 5. The average cumulative sales tax rate in Egeland North Dakota is 5.

Your household income location filing status and number of personal exemptions. Rates include state county and city taxes.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

The Consumer S Guide To Sales Tax Taxjar Developers

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

State Corporate Income Tax Rates And Brackets Tax Foundation

Tax Calculator For Items Hot Sale 58 Off Www Ingeniovirtual Com

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

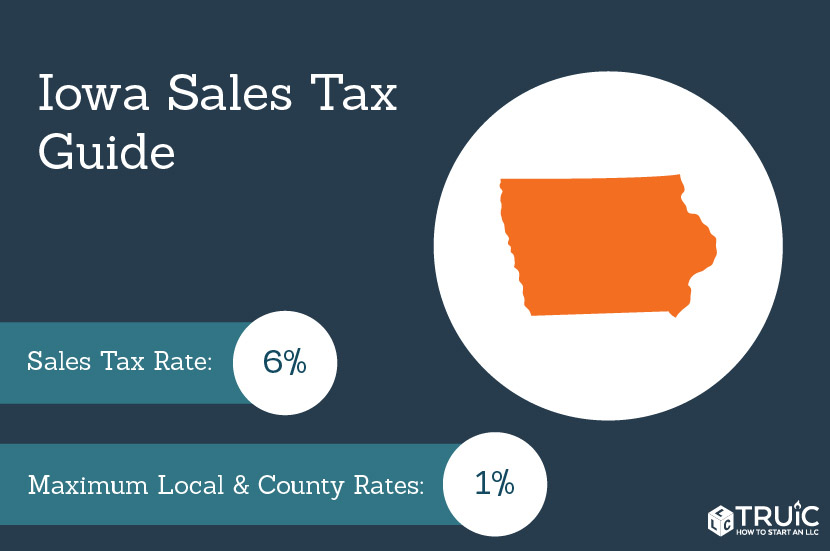

Iowa Sales Tax Small Business Guide Truic

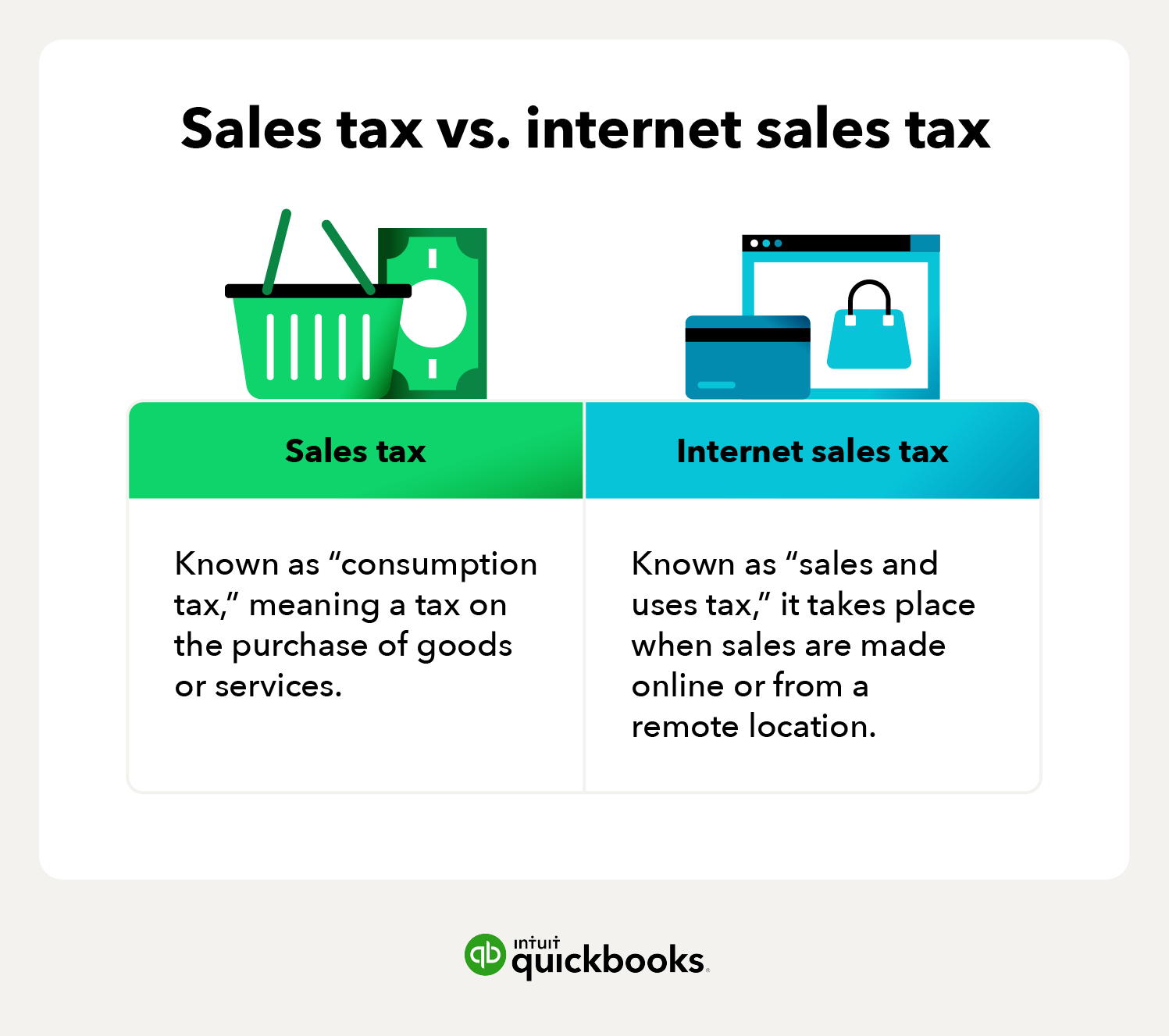

Internet Sales Tax Definition Types And Examples Article

North Dakota Sales Tax Rates By City County 2022

Internet Sales Tax Definition Types And Examples Article

What Is Sales Tax A Complete Guide Taxjar

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price